Do Tax Preparers Make Good Money?: Self-employed people always seem to have the highest job security in today’s economy. Entrepreneurship rewards individuality, financial security, and more.

Imagine having your own safe stream of income — with infinite opportunity! You can set up a wonderful new home-based company that can be part-time or full-time and also expands into a brick and mortar business.

Inspiring your journey, one story at a time. #LifeFalcon.

The decision is yours, and it will always be because you are the owner of the company. In an effort to save money or finally grasp your finances, you may think it’s a smart idea to pay your own taxes.

But when you’re making a move, you didn’t expect any of the IRS jargon, complicated tax laws, and their latest reforms to push you to the track.

Table of Content

What is a tax preparer?

The tax preparer is a skilled professional who is knowledgeable about the tax rules, methods, and traditions of tax reporting.

They normally charge higher prices for their assistance. The charge varies widely depending on the ease or difficulty of your tax affairs.

Tax preparers shall prepare the taxes in compliance with the guidance provided by the Internal Revenue Service ( IRS).

This guidance can be complicated and may differ from year to year in some cases. If you’re unsure about these tax rules and how they can relate to your particular financial condition, hiring a tax preparer might be a big help.

Who needs a tax preparer?

You should try hiring a tax preparer if you’re short on time dreaming about filing your own taxes.

You find like you don’t grasp the tax consequences of your financial practices.

In addition, the following groups of individuals could strongly consider hiring a tax preparer.

Where can you find a tax preparer?

Ask your family and friends for references to reputable, verified tax preparers. Any independent preparers can also provide discounts for family and friends referrals.

You can easily locate tax preparers in your area via local Google, Yelp, or Facebook listings. You can easily locate tax preparers in your area via local Google, Yelp, or Facebook listings.

They usually have scores and recommendations that will help you determine if they suit your needs.

Global franchises such as H&R Block and Jackson Hewitt have offices around the country and will set up more during the tax season. Check their websites for an office near you.

Benefits of starting a tax business

The advantages of tax preparers are to earn $100 / hour or more as a seasoned accountant, reduce your own tax obligation, and make your skills more marketable.

If Job is a tax preparer for 3 months of the year, you can make a big income and feel more comfortable – you can manage your own fate Start at home with small expenses.

It’s easier and less expensive than you think!

Tax preparers need low start-up costs and the tax company will start quickly.

No concession fees or profits are required, and no accounting history or degree is required.

Huge growth potential

Millions of Americans pay tax practitioners to plan and file their tax returns each year, and Congress continues to make more adjustments to the tax code.

These reforms render taxpayers much more uncertain and disappointed and seek the support of tax practitioners more than ever before.

When the number of taxpayers continues to rise, so does the demand for skilled tax practitioners.

And now, with new improvements to the US economy, it is more important than ever for taxpayers to demand all the exemptions and deductions they owe and spend far more than the same amount of taxes they owe.

Starting your own tax company would allow you to satisfy this rising demand and give you the stability and protection you deserve.

High-income potential

The amount of money you can earn depends on your business and how quickly you can draw customers.

Through the tax planning of your home company, you would have very little overhead; thus, you have the potential to spend less than the rivals.

A skilled independent tax specialist will earn up to $100 an hour. That’s $5,000 a week for a 50-hour week or $60,000 for a 3-month tax season!

You’re not going to gain that much in the first tax season because you’re always studying and hiring potential customers.

But by selling strategically and offering outstanding customer support, you can expand by high customer engagement and referrals and easily hit the income level with just 3 months of work and continue to develop your tax business!

What is much more promising is that as your company expands through new customers and referrals, your opportunity for future profits is even higher

you can enjoy your summers and holidays as most of your company is created during the focused filing season from mid-January to mid-April.

you might start delivering other resources to your tax clients and producing revenue all year round.

Better than a franchise

Here are just some of the reasons why starting your own tax planning business makes more sense than investing into a tax service franchise.

Making your own tax company means avoiding expensive start-up costs, royalty charges, financial aid issues, territorial limitations and franchise legal redress problems should go wrong.

You get to do it your way by using imaginative power. NO contract conditions – do you know what you can do years from now and no issues with inadequate assistance from the franchisor?

Fair Prices for supplies — no franchises or mark-ups. FREEDOM for non-competition clauses do you decide to remove from the franchise

AVOID promotional fees that do not benefit the franchise and losses your business due to the undue termination of your franchise.

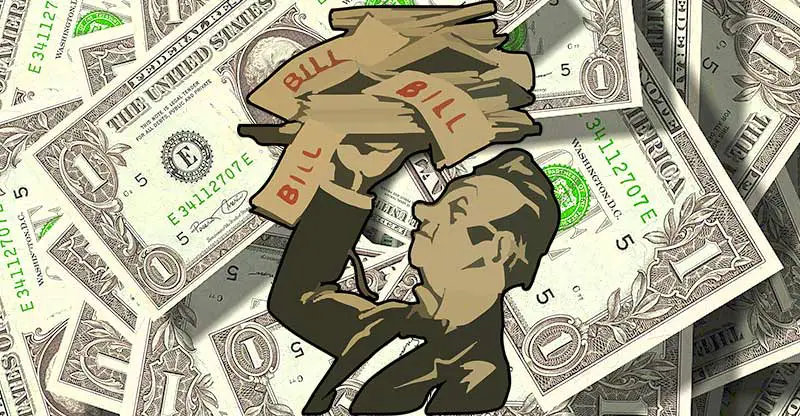

How Your Tax Preparer is Really Making Money?

Finally, it’s really necessary to consider how the tax preparer is really making money. And it might not be quite clear from the beginning.

Next, the tax preparer would generally either pay a flat rate to process your return or charge you monthly, based on the setup.

If you have a simple refund, you may plan to pay up to $150 (which was the average reimbursement for tax filing at the H&R Block in 2014).

However, if you use a CPA and have a company that needs numerous returns, 1099s to be mailed, and more, you might possibly cost over $1,500 to file your tax return(s).

But actual tax revenue doesn’t come from making refunds, but from selling add-ons. Tax preparers profit large and small from up-selling their clients to a range of products.

The most common additions are advance tax return loans, savings plans, and benefits. The one you’re actually better acquainted with is a refund waiting for a loan.

This is where the organization offers to let you leave the supermarket with a part of your refund today. It’s a big selling point, but it will cost you a lot of time.

For example, if you want a $1,000 return, they will lend you up to $600 (or some other percentage).

If you don’t spend $600 by the due date, the tax preparer will continue to use the tax refunds to pay the loan, interest, and related expenses.

This is a very expensive way to be impatient, and once you look at what you expect your tax return, you will know that 90 percent of the tax refunds will be given within 21 days. Only wait it out of here!

Another big product that tax preparers are setting up is a savings plan to bank your refund. The preparer would then obtain a fee from the brokerage firm where you open an account.

Although this isn’t always a negative thing, you want to make sure that the account really meets your needs.

Much of the people who sign up for this don’t understand what they’re getting into and break the rules of the account (like withdrawing money).

This, in fact, lets them spend higher in taxation and fees for the next year.

Finally, many tax preparers and even some CPAs will provide protection to their customers as a piece of mind for eventual auditing.

They appear to provide insurance in order to offset future back-taxes, fines, damages, and more.

What they don’t tell you, though, is that you don’t need to have this insurance because you’re still protected by the deal you reached with them to pay your taxes.

If you read the fine print of the deal (with all the main chains of tax preparers and also in most CPAs), they will normally have a promise that if they have a mistake, they will pay back taxes, fees, and fines.

If you’re unsure, inquire in advance. This is exactly what the protection for mistakes and omissions is meant for.

Our Verdict

The bottom line is that just because your tax preparer doesn’t tell you something means you can turn a blind eye to it. Now that you know what you’re looking for, you would need to inquire in advance.

That’s the safest way to shield yourself from paying for poor service, or worse, from having to deal with an IRS audit. The decision is yours: do your homework or cross your fingers with an oblivious joy.